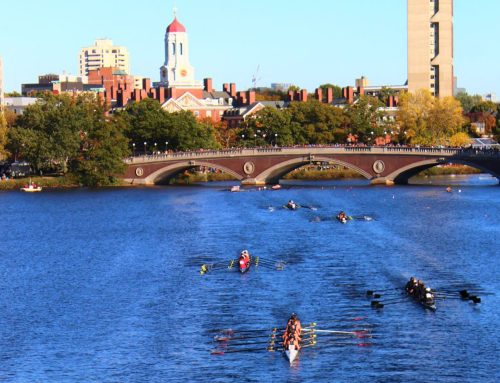

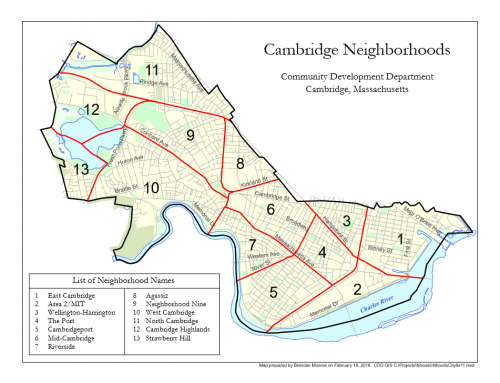

“Nonprofit Row,” home to the Foundation and nearly a dozen other Cambridge nonprofits.

Giving is an impactful way to benefit your community, but it’s important to consider how you give. There are numerous ways to support local nonprofits. From an unrestricted gift of cash, to buying tickets for an annual gala, to opening a donor advised fund (DAF). A donor advised fund is one charitable giving vehicle that can stretch your dollars further and maximize the impact of your donation.

DAFs have been gaining popularity in recent years and are a wonderful way to support nonprofits you care about.

What is a donor advised fund?

A DAF is similar to an investment account with the sole purpose of supporting charitable organizations that are important to you.

Assets contributed to a DAF do not have to solely be cash. Individuals may contribute publicly traded securities, bitcoin, real estate, mutual fund shares, and certain complex assets (such as privately held C-corp and S-corp shares). Your donation will then grow in your account tax-free based on your investment preferences. The assets accumulated in a donor advised fund can be used to support virtually any charity that is qualified by the IRS as a 501(c)(3) public charity.

If you choose to establish a DAF with the Cambridge Community Foundation, you gain the benefit of direct guidance from the Foundation in making charitable gifts and having the greatest impact in our community.

To set up a donor advised fund, you simply make a tax-deductible donation into a charitable fund account managed by a fund holder, such as the Cambridge Community Foundation. You name the ‘advisor’ and any successor advisors to the account, as well as the charitable beneficiaries. The advisor on the account directs how much and how often the funds go to the charitable beneficiaries.

Tax advantages of a donor advised fund

A donor advised fund is one of the most tax-efficient ways to conduct philanthropy and offers many tax advantages. You will receive a tax deduction for any gifts you make to your DAF. Furthermore, any growth in your fund will not be taxed, since those assets belong to the donor advised fund’s charitable sponsor. Even if the assets are not immediately distributed to charity, you still get the benefit of the full tax deduction in the year you make the gift to your DAF. For example, if you create a DAF with an initial $10,000 contribution, you may structure the payouts in increments of $1,000 per year over 10 years.

Donor advised funds are particularly useful after a windfall situation such as selling a business or receiving a large inheritance. The tax deduction from contributions to a DAF will immediately reduce your tax liability.

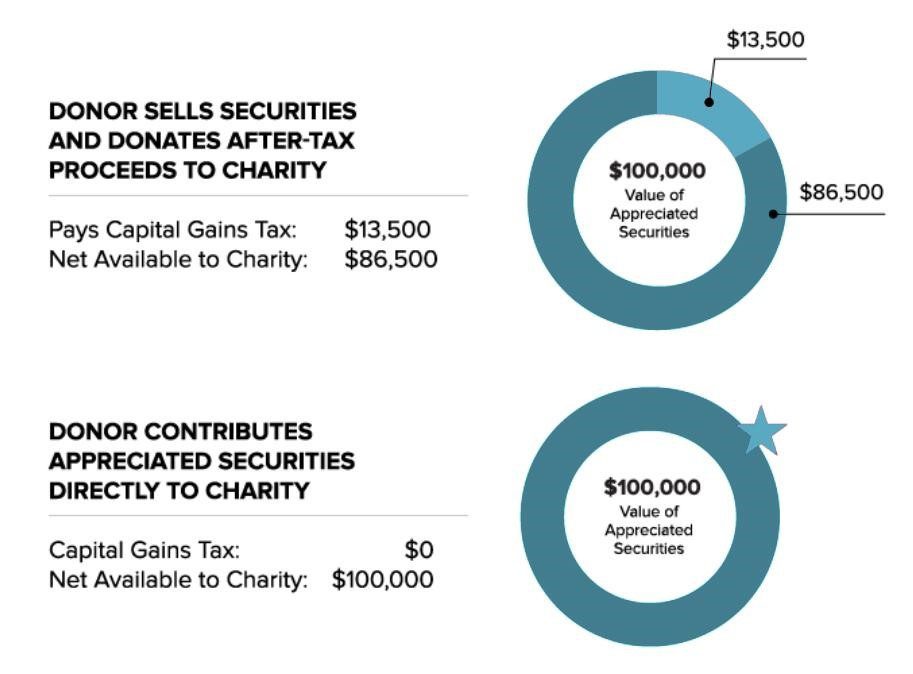

There is also a tax benefit to donating appreciated stock, rather than liquidating stock and donating the proceeds. Stock donations can reduce an individual’s capital gains tax liability and marginal income tax. The example below illustrates the benefit of donating appreciated securities directly to charity.

Private foundations versus donor advised funds

Private foundations are an alternative to donor advised funds, but they aren’t as attractive. Private foundations are run like a business and are ultimately costly and time consuming to maintain. Unlike a DAF, private foundations require legal fees to set up; one to two percent of annual investment income is subject to excise tax; and many administrative responsibilities are involved. With a private foundation, assets must be managed, records need to be kept, and state and federal tax returns need to be filed. Donor advised funds have less overhead, improved tax deductions, and greater grant flexibility.

There are two main advantages for establishing your donor advised fund with the Cambridge Community Foundation, instead of with a major financial institution. First, all DAFs are subject to administrative charges (a percentage established by each entity per their published fee schedules). The administrative charge for any major financial institution is a fee that gets paid back to the for-profit banking entity. The administrative fee associated with the Cambridge Community Foundation’s DAF goes back to the Foundation to further support its mission and charitable work.

Second, donors with a DAF at the Foundation have access to the Foundation team, who can guide them on where to direct their charitable grants to have the most impact on the community and their philanthropic goals. This guidance is offered at most financial institutions, but typically only for gifts over one million dollars. When you establish a DAF with the Foundation, there is no such minimum, and every donor with a DAF has a personal contact and resources available to ensure that their gifts go toward the causes they care about.

The Foundation has partnered with Cambridge Trust and Bank of America to make giving through a DAF to the Foundation easy and impactful. There is a $10,000 minimum for DAFs, and contributions can be added to the fund at any amount.

For more information on creating a DAF at the Cambridge Community Foundation, please contact Michal Rubin, Vice President of Development, [email protected].

Kristin Dzialo is an attorney at Eckert Byrne, LLC and a member of the Professional Advisors Council at the Cambridge Community Foundation.